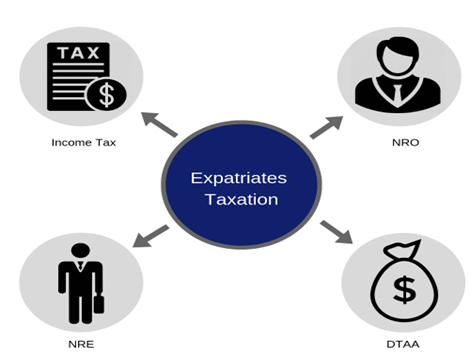

The Income Tax Act of 1961 does not define the word "Expatriate Tax." However, in broad terms, an expatriate is a person who resides in a nation other than his or her country of origin or citizenship. His residence in another nation might be either temporary or permanent, depending on the terms of his deputation. A "deputation" occurs when an employee is temporarily transferred to a position outside of his cadre.

The following factors determine the incidence of tax under the Income Tax Act of 1961:

Kinds of Expatriates

There are two kinds of Expatriate:

The work requirement for expatriates is dependent on whether the assignment is a:

Compliance Requirements for Foreign Citizen Entering or Leaving in India

If the requirement has been raised as per their visa endorsement, all inbound expatriates (including minors over the age of 16) entering India on a long-term visa for more than 180 days must register with the Foreign Regional Registration Office (FRRO) within 14 days of their arrival.

Such inbound expats are required to turn in their residence permits to the FRRO/FRO or the immigration officer at the border. The Income Tax Act also allows expats to file Form 30A in order to receive a "No Objection Certificate" granted through Form 30B. Form 30A is an assurance from the expatriate's employer that any potential tax liabilities for the employee must be covered by the employer.

Taxability of Inbound Expatriates in India

Finding out a person's residency status and the amount to which their income is taxed in India, where the nexus of income is defined, is the first stage in computing the income connected with an inbound expatriate.

| Resident and Ordinarily Resident | Resident But not Ordinarily Resident | Non Resident |

|---|---|---|

| (ROR) | (RNOR) | (NR) |

| Global income is taxable in India | Income accrued or received in India. | Any Income accrued/received in India is taxable in India. |

| Income earned through business controlled in India. |

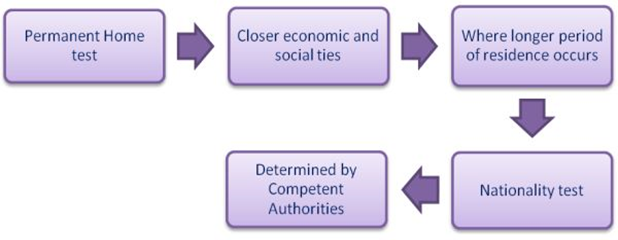

It is crucial to remember that the Income Tax Act and the Double Taxation Avoidance Agreement (DTAA) will both be taken into consideration when determining an expat's residence status. An incoming expatriate may occasionally be regarded as a resident of both nations under the DTAA and the applicable tax legislation. In this situation, the 'Tie Breaker Rules' will be used to decide on the residential status.

Taxability of Salary Income in India

Subject to exclusions allowed by the Income Tax Act and the Double Taxation Avoidance Agreement (DTAA), an incoming expatriate is required to pay taxes in India for the money obtained from rendering services there.

Component of Salary Income in case of Expatriates (Perquisites & Allowances)

Short Stay Exemption

If the following criteria are satisfied, all such revenues received by an expat in India are not subject to taxation under the Income Tax Act:

Concept of Tax Equalization

The idea of tax equalization has been adopted to guarantee that expatriates don't end up paying more taxes. Under this concept, a fictitious tax is taken from the wage in the home country, and the employer is responsible for paying the actual tax on employees' income from work in both the home country and India. The employer then pays all of the taxes related to the home country and India after deducting this hypothetical tax from the expat's regular income and holding it in reserve.

Other Important Compliances that an Expatriate must keep in Mind

Foreign nationals come for job opportunities to India but are many a times not aware of Indian Taxation system. Even the Visa compliance is linked with tax certificates. We understand the difficulties that may strike their way. Many Non Resident Indians have investments in Indian properties and other business interests in India. Divestments and other activities involve taxation processes also. We provide non residents including NRIs best of the best solutions to advice on the taxes applicable on them and to plan those taxes effectively.