Company registration in India is the legal process through which a business entity is formally recognized and established as a separate legal entity under the provisions of the Companies Act, 2013. It is a crucial step for entrepreneurs and businesses looking to operate within the Indian legal framework.

Registering a company in India offers several advantages, including limited liability protection, easier access to funding, legal recognition, and enhanced credibility in the business ecosystem. The process of company registration is governed by the Ministry of Corporate Affairs (MCA) and the respective Registrar of Companies (ROC) in each state.

There are different types of companies that can be registered in India, including:

In India, there are several business structures or forms under which an entity can be established and operated. The choice of business structure depends on factors such as the nature of the business, ownership preferences, liability considerations, regulatory requirements, and tax implications. The main types of business structures in India include:

To register a company in India, several documents are required. The specific documents may vary depending on the type of company and other factors, but generally, the following documents are commonly needed:

1. Identity and Address Proof of Directors:

2. Passport-sized Photographs of Directors:

3. Proof of Registered Office Address:

4. Consent to Act as Directors (DIR-2):

5. Declaration by First Subscribers and Directors (INC-9):

6. Memorandum of Association (MOA):

7. Articles of Association (AOA):

8. Digital Signature Certificate (DSC):

9. Director Identification Number (DIN):

10. Other Documents (if applicable):

Registering a company in India offers several benefits, which contribute to its attractiveness as a business destination. Some of the key benefits of company registration in India include:

Refers to a set of recommendations or principles aimed at helping individuals or businesses select an appropriate and effective name for their company. Choosing the right company name is crucial as it serves as the primary identifier of the business and can significantly impact its branding, marketing, and overall success. These guidelines provide a framework for evaluating and selecting a company name that aligns with the business's identity, objectives, and target audience.

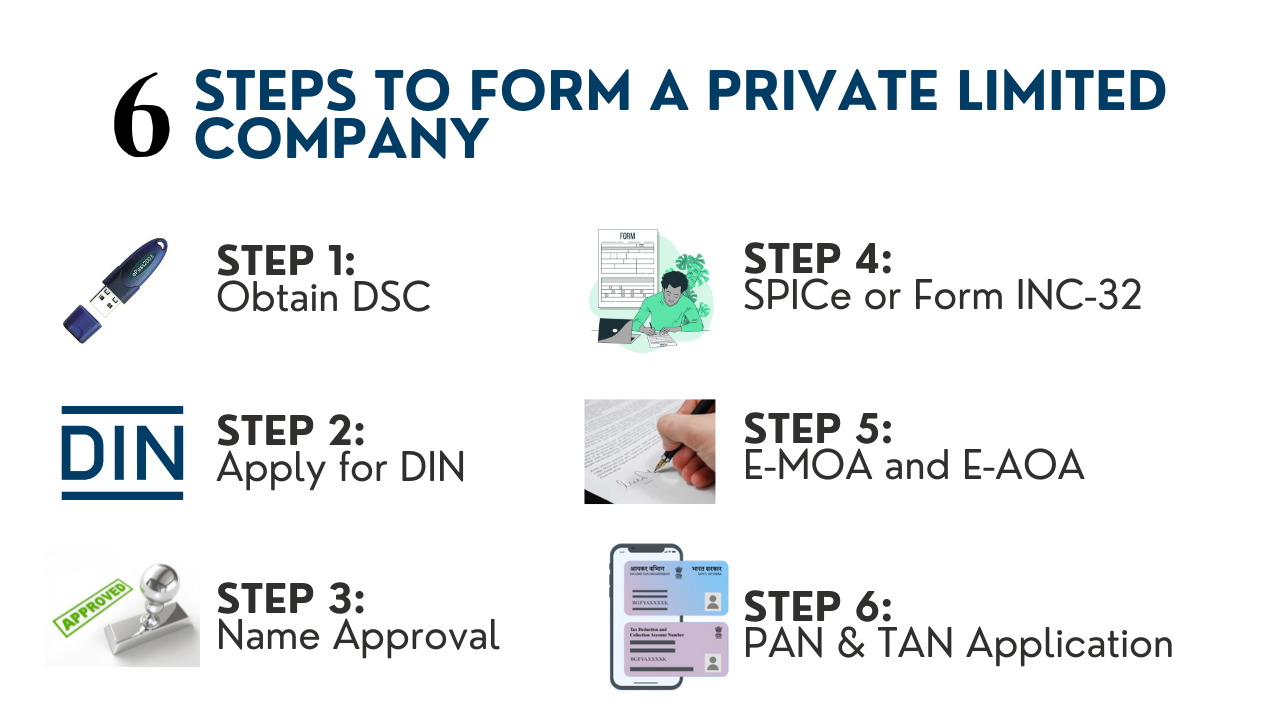

Registering a Private Limited Company in India involves several ways and procedures. Then is a detailed companion:

Step 1: Obtain Digital Signature Certificates (DSC)

All proposed directors of the company need to gain a Digital hand Certificate( DSC) from government- approved agencies. This is necessary for digitally subscribing the documents during the enrollment process.

Step 2: Director Identification Numbers (DIN):

Each director must apply for a Director Identification Number( noise) online through the Ministry of Corporate Affairs( MCA) website. noise is a unique identification number needed for directors to incorporate a company.

Step 3: Name Reservation:

Step 4: Preparation of Incorporation Documents

Draft the Memorandum of Association( MOA) and Articles of Association( AOA) for your company. These documents define the objects, rules, and regulations of the company.

Step 5:Fill SPICe( Part B)

Fill out the SPICe( Simplified Proforma for Incorporating Company Electronically) form( Part B) online on the MCA gate. This form includes details similar to company directors' information, registered office address, share capital details,etc.

Step 6: Upload Documents

Step 7: Payment of Registration Fees:

Pay the prescribed registration fees based on the authorized share capital of the company through the MCA portal.

Step 8: Certificate of Incorporation

Once the Registrar of Companies( ROC) verifies the operation and documents, they will issue a Certificate of Incorporation. This document fairly establishes the Private Limited Company.

Step 9: PAN and TAN Application:

Apply for endless Account Number( visage) and Tax Deduction and Collection Account Number( TAN) for the recently incorporated company.

Step 10: Post-Incorporation Compliance

After objectification, insure compliance with ongoing nonsupervisory conditions similar as holding board meetings, maintaining statutory records, filing periodic returns,etc.

It's judicious to seek professional backing from chartered accountants, company registers, or legal counsels to ensure compliance with all legal conditions and streamline the enrollment process.

Registering a procurement company in India is a straightforward process compared to other business structures. Then is a step- by- step companion to register a procurement company:

Step 1: Choose a Business Name

Select a unique name for your procurement business. You may choose to use your own name or a fictitious business name.

Step 2: Obtain Necessary Licenses and Permits:

Identify and obtain any specific licenses or permits required for your business activities. This may include local business licenses, health permits, trade licenses, etc., depending on the nature of your business.

Step 3: Open a Bank Account

Open a current bank account in the name of the procurement business. You'll need the visage card and other identity/ address attestations to open the account.

Step 4: Register for GST( Goods and Services Tax)

If your business development exceeds the threshold limit specified by the government, you need to register for GST. Visit the GST portal and complete the enrollment process.

Step 5:Register for Professional Tax( if applicable)

Depending on the state where your business is located, you may be needed to register for professional duty. Check the original regulations and complete the enrollment process if applicable.

Step 6: Gain Licenses and Permits

Depending on the nature of your business, you may need to gain specific licenses and permits from non supervisory authorities. For illustration, if you are operating in food assistance, you may need FSSAI( Food Safety and Standards Authority of India) enrollment .

Step 7: Register with Shops and Establishments Act

Register your business under the separate state's Shops and Establishments Act. This enrollment is obligatory for businesses operating from a marketable establishment.

Step 8: Obtain Other Enrollments( if applicable)

Depending on the nature of your business, you may need to gain fresh enrollments similar to MSME enrollment , professional licenses,etc.

Step 9: Maintain Records

Maintain proper records of your business deals, income, and charges. This will be helpful for duty form and other compliance conditions.

Step 10: Renewals and Compliance

Renew your licenses and enrollments periodically as per the renewal conditions. insure compliance with all nonsupervisory and duty- related scores.

It's essential to consult with a legal or fiscal counsel to understand the specific conditions and regulations applicable to your business and insure compliance with all legal and nonsupervisory conditions.

Registering an incipient company in India involves several ways and procedures. Then is a detailed companion:

Step 1: Choose a Business Structure

Decide on the type of business structure for your incipiency, similar as a Private Limited Company, Limited Liability Partnership( LLP), One Person Company( OPC),etc., grounded on your business model, backing conditions, and growth plans.

Step 2:Obtain Digital hand Certificate( DSC)

All proposed directors of the company need to gain a Digital hand Certificate( DSC) from government- approved agencies. This is necessary for digitally subscribing the objectification documents.

Step 3: Obtain Director Identification Number( noise)

Each director must apply for a Director Identification Number( noise) online through the Ministry of Corporate Affairs( MCA) website. noise is a unique identification number needed for directors to incorporate a company.

Step 4: Name Approval

- Choose a unique name for your Startup in India and check its availability on the MCA website.

- Apply for name approval through the RUN (Reserve Unique Name) service on the MCA portal. Alternatively, you can file Form SPICe+ (Part A) for name reservation along with other incorporation documents.

Step 5: Preparation of Incorporation Documents

Draft the Memorandum of Association (MOA) and Articles of Association (AOA) for your startup. These documents define the objectives, rules, and regulations of the company.

Step 6: Fill SPICe+ (Part B)

Fill out the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form (Part B) online on the MCA portal. This form includes details such as company directors' information, registered office address, share capital details, etc.

Step 7: Upload Documents

Step 8: Payment of Fees

Pay the prescribed fees online for company incorporation and other related services. The fee structure depends on the authorized share capital of the company.

Step 9: Certificate of Incorporation

Once the Registrar of Companies (ROC) verifies the application and documents, they will issue a Certificate of Incorporation. This document legally establishes the startup company.

Step 10: PAN and TAN Application

Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the newly incorporated company.

Step 11: Post-Incorporation Compliance

After incorporation, ensure compliance with ongoing regulatory requirements such as holding board meetings, maintaining statutory records, filing annual returns, etc.

It's advisable to seek professional assistance from chartered accountants, company secretaries, or legal advisors to ensure compliance with all legal requirements and streamline the registration process. Additionally, startups may also explore various government schemes and initiatives aimed at supporting and promoting startup entrepreneurship in India.

Registering a construction company in India involves several steps and procedures. Here's a detailed guide:

Step 1: Choose a Business Structure

Decide on the type of business structure for your construction company, such as a Private Limited Company, Limited Liability Partnership (LLP), Partnership Firm, Sole Proprietorship, etc., based on your business model, funding requirements, and growth plans.

Step 2: Obtain Digital Signature Certificate (DSC)

All proposed directors or partners of the company need to obtain a Digital Signature Certificate (DSC) from government-approved agencies. This is necessary for digitally signing the incorporation documents.

Step 3: Obtain Director Identification Number (DIN) or Designated Partner Identification Number (DPIN)

Each director or designated partner must apply for a Director Identification Number (DIN) or Designated Partner Identification Number (DPIN) online through the Ministry of Corporate Affairs (MCA) website.

Step 4: Name Approval

Step 5: Preparation of Incorporation Documents

Prepare the necessary incorporation documents based on the chosen business structure. This may include Memorandum of Association (MOA), Articles of Association (AOA), Partnership Deed (for partnership firms), etc.

Step 6: Fill Incorporation Forms

Fill out the relevant incorporation forms online on the MCA portal or LLP portal. For example, if registering a Private Limited Company, fill out the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form.

Step 7: Upload Documents

Upload the required documents along with the incorporation forms. These documents may include identity proofs, address proofs, consent forms, partnership deeds (if applicable), etc.

Step 8: Payment of Fees

Pay the prescribed fees online for company incorporation and other related services. The fee structure varies based on the chosen business structure and authorized capital.

Step 9: Certificate of Incorporation or Registration

Once the Registrar of Companies (ROC) or Registrar of LLP verifies the application and documents, they will issue a Certificate of Incorporation (for companies) or Registration Certificate (for LLPs). This document legally establishes the construction company.

Step 10: PAN and TAN Application

Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the newly incorporated company.

Step 11: Post-Incorporation Compliance

After incorporation, ensure compliance with ongoing regulatory requirements such as holding board meetings, maintaining statutory records, filing annual returns, etc.

It's advisable to seek professional assistance from chartered accountants, company secretaries, or legal advisors to ensure compliance with all legal requirements and streamline the registration process for your construction company. Additionally, consider obtaining relevant licenses, permits, and certifications required for operating a construction business in India, such as building permits, environmental clearances, labor licenses, etc.

Ruchi Anand & Associates is a group of account professionals, furnishing end to end results in diversified fields of business establishment and handling, beginning from enrollment of companies in India to regular compliance and fiscal Reporting, Auditing and other areas of Advisory and consultancy.

Establishment has precious professionals who have core capabilities to give all the services of account and finance, including compliance part under one roof, in a fashion that keeps our guests at comfort. Our Advantages

We’re Always Available

You can contact us on our given contact details. You can even chat with our experts by entering your email, phone number and request a callback. Our experts will contact you and clear all your queries.

If you have any questions to wish to know more about “Company registration in India”, kindly Contact us.